Interoperability has always been the unlock for network scale.

Every major network’s inflection point came after closed systems became connected systems.

A short history 👇

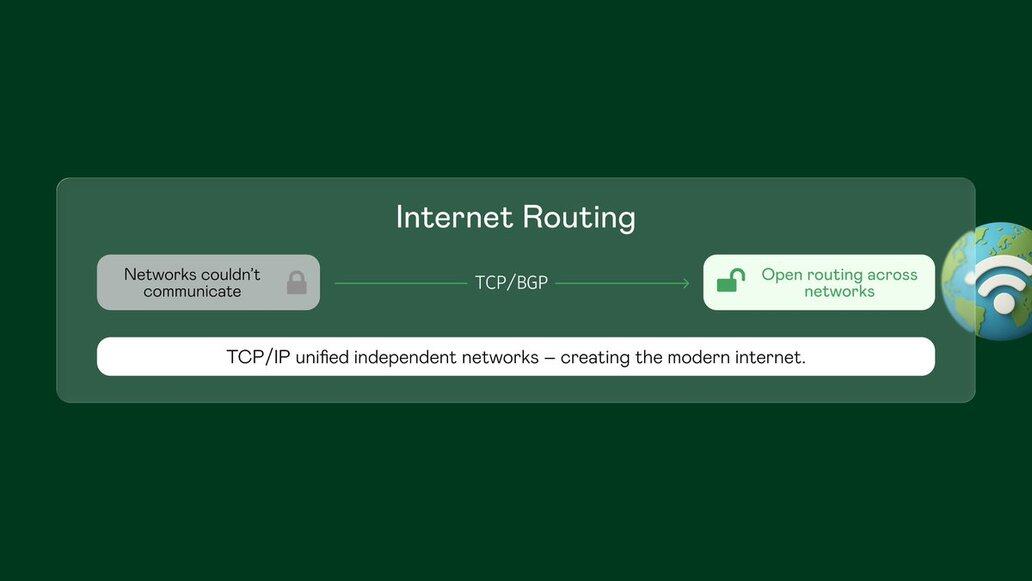

2/ The early internet was a collection of isolated networks - ARPANET, NSFNET, private systems - all speaking different dialects.

The adoption of shared standards like TCP/IP + BGP unified them and created the modern internet = global transfer of information.

3/ Email followed the same pattern.

Before SMTP, providers were closed silos. You couldn’t reliably send a message outside your network.

SMTP turned email into a universal communication layer and one of the first global protocols = global transfer of data.

4/ SMS had the same problem.

Originally, you could only message people on your own carrier.

Cross-carrier interoperability made SMS universal and unlocked one of the largest communication networks in the world = global transfer of messaging.

5/ Payments followed the same arc.

Early cards only worked at the issuing bank’s terminals.

ISO 8583 and interbank networks made “any card, any merchant” possible and created the modern payments ecosystem = global transfer of money.

6/ Across all of these examples, the pattern is consistent:

Closed → interoperable → global

Siloed → standardized → scaled

Interoperability is the point where a technology moves from early-market niche to global usability.

7/ Crypto and stablecoins haven’t reached that point yet.

‣ Chains operate as isolated systems.

‣ Liquidity is fragmented.

‣ Value movement is inconsistent and often non-standard.

We are still in the pre-SMTP, pre-TCP/IP, pre-ISO 8583 era.

8/ Post-GENIUS, new chains and assets will proliferate.

The breakthrough won’t come from more chains.

It will come from connecting them - across assets, across platforms, and across instruments.

9/ @zerohashx has been building toward this since 2017.

We power onchain movement for the world’s largest enterprises, and we understand their requirements: trust, interoperability, technical abstraction and usability.

We’re uniquely positioned, and fully focused, on enabling interoperability across assets, chains, and instruments.

10/ Step 1 was technical abstraction: making it simple for major companies to offer onchain products without needing blockchain expertise.

Step 2 is interoperability: enabling value to move seamlessly, regardless of where it originates or where it needs to go.

That’s zerohash’s C³ - the rails that allow interoperability at scale, via a single API.

11/ The lesson across every major network is straightforward:

Interoperability is the unlock.

Stablecoins and tokenized assets are approaching their interoperability inflection point = the global transfer of value.

2.83 ألف

17

المحتوى الوارد في هذه الصفحة مُقدَّم من أطراف ثالثة. وما لم يُذكَر خلاف ذلك، فإن OKX ليست مُؤلِّفة المقالة (المقالات) المذكورة ولا تُطالِب بأي حقوق نشر وتأليف للمواد. المحتوى مٌقدَّم لأغراض إعلامية ولا يُمثِّل آراء OKX، وليس الغرض منه أن يكون تأييدًا من أي نوع، ولا يجب اعتباره مشورة استثمارية أو التماسًا لشراء الأصول الرقمية أو بيعها. إلى الحد الذي يُستخدَم فيه الذكاء الاصطناعي التوليدي لتقديم مُلخصَّات أو معلومات أخرى، قد يكون هذا المحتوى الناتج عن الذكاء الاصطناعي غير دقيق أو غير مُتسِق. من فضلك اقرأ المقالة ذات الصِلة بهذا الشأن لمزيدٍ من التفاصيل والمعلومات. OKX ليست مسؤولة عن المحتوى الوارد في مواقع الأطراف الثالثة. والاحتفاظ بالأصول الرقمية، بما في ذلك العملات المستقرة ورموز NFT، فيه درجة عالية من المخاطر وهو عُرضة للتقلُّب الشديد. وعليك التفكير جيِّدًا فيما إذا كان تداوُل الأصول الرقمية أو الاحتفاظ بها مناسبًا لك في ظل ظروفك المالية.