When the tide recedes, I know who is swimming naked. 👇

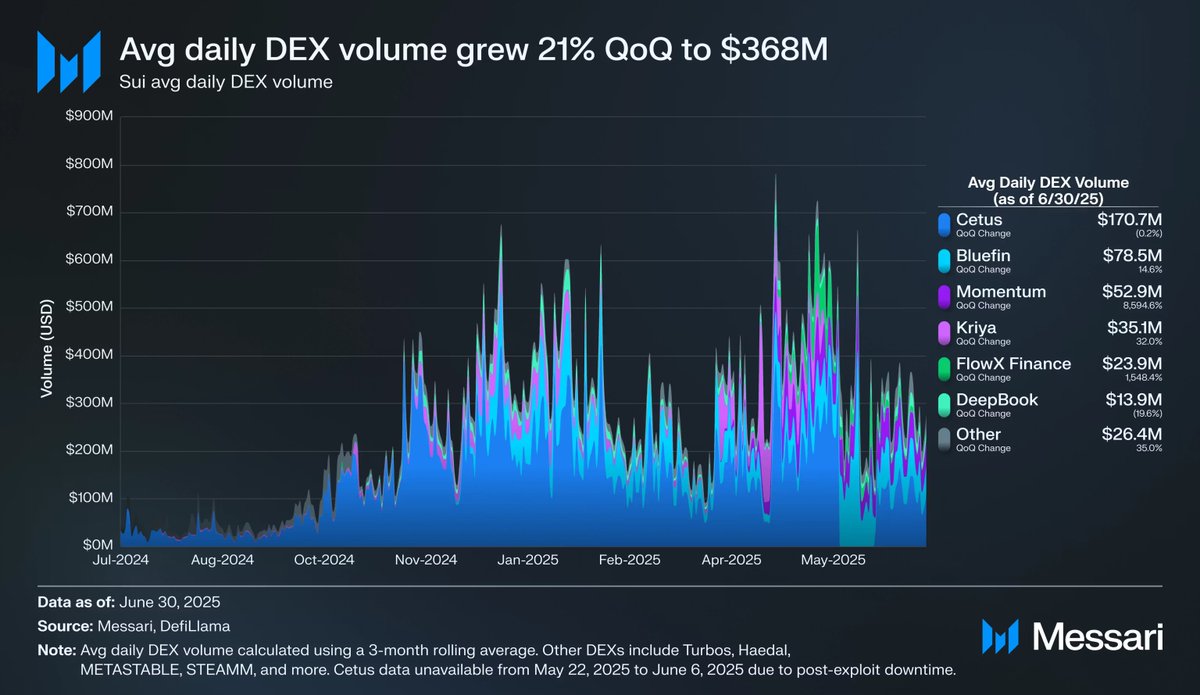

Recently, the entire @SuiNetwork ecosystem has been making low-key efforts, with the average daily trading volume in Q2 reaching $368 million, and the TVL rising to 1.76 billion, with Grayscale and 21Shares entering the market. It is clear that money and people are pouring into $SUI.

At times like this, the most important question to think about is: who can really carry Sui's liquidity?

My answer is: @MMTFinance ( $MMT )

The on-chain performance is impressive, and it has recently logged into the @KaitoAI Dashboard, which is amplifying transparency and market attention.

@MMTFinance is not a regular DEX, but a multi-chain ve(3,3) model, with 80% lower fees than others and higher LP returns. Shortly after its launch, TVL has firmly ranked in the forefront, and Multichain Vaults have also been launched to collect multi-chain funds.

You can think of it as Curve + Uniswap + Coinlist on Sui: it is not only the core of liquidity, but also the home of stablecoins and BTCFi, and by the way, it has also made a Launchpad, which directly stuck the ecological bloodline.

In the DeFi game, whoever controls liquidity controls the future, and for me, @Momentum = liquidity on Sui is the answer.

👉 For a visual experience, check out the real-time data here:

History does not simply repeat itself, but it always rhymes.

In terms of the ability to allocate resources, @solana and @SUINetwork must be at the forefront.

Sui's monthly DEX trading volume hit a record high, reaching $14.265 billion in July, and SUI has already begun to demonstrate its resource allocation and integration capabilities.

@Flywheel_DAO & @FOMO_v

Lets build! 🫶 @web3crusadr 💧

18.14K

62

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.