Really good take on Aave Horizon market. Horizon offers stablecoin yield against traditional assets such as money market funds. Great for diversifying yield sources.

If you're looking for a low-risk yield play in DeFi today, you should pay attention to Horizon market by @aave.

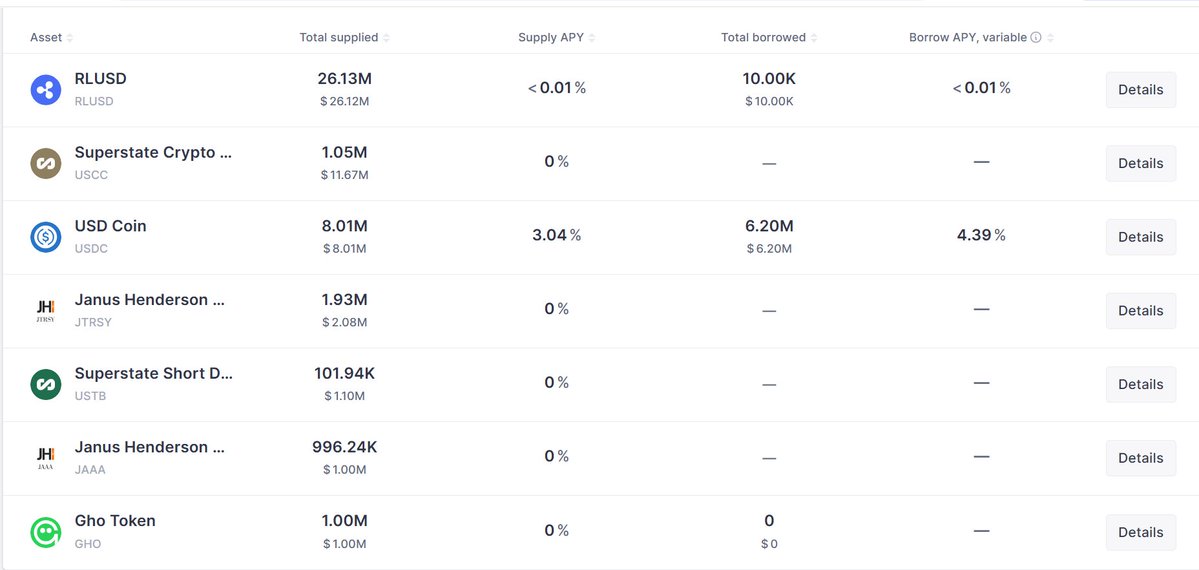

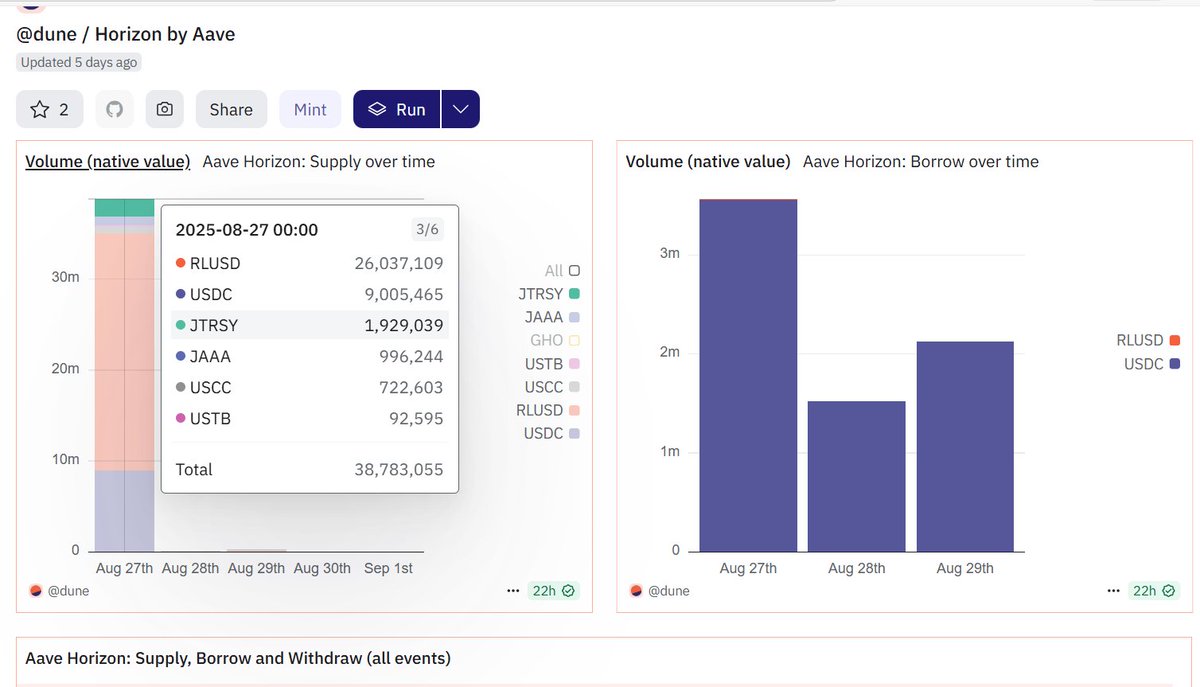

Horizon, the RWA-backed lending market on Ethereum, crossed $50M in net deposits just within 2 days of launch.

To be honest, this might be the cleanest bridge we’ve seen between TradFi and DeFi so far.

Here’s how it works:

Institutions deposit tokenized real-world assets (like U.S. Treasuries) and borrow stables against them.

Anyone can supply those stablecoins into Horizon’s pools and earn yield from these institutional borrowers.

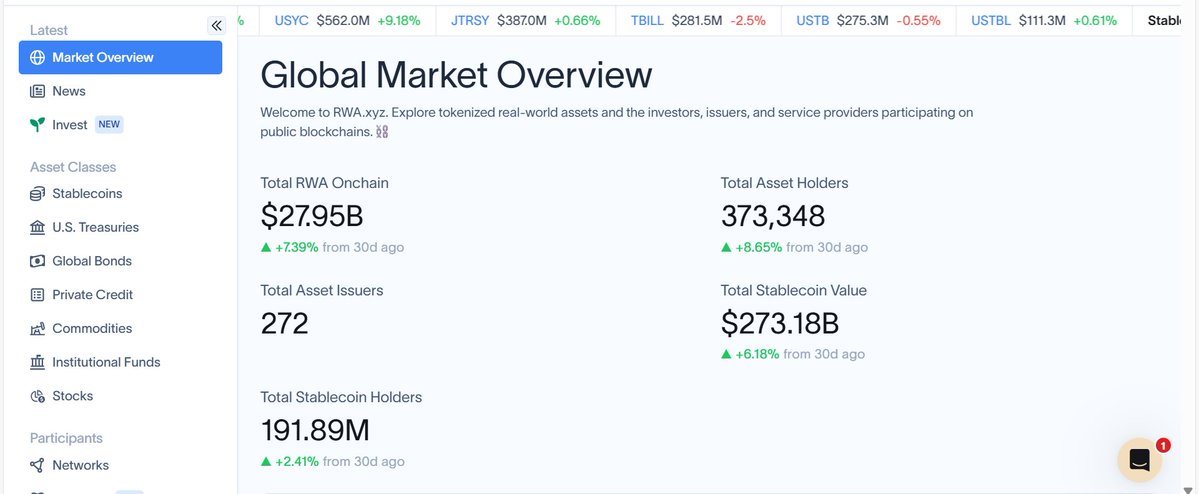

FYI, The RWA market is currently $28B.

The stats don't lie:

. Horizon already had $50M+ in market size

. $7M borrowed

The design allows institutions to maintain exposure to safe-yield assets while accessing 24/7 liquidity that is unavailable in Banks.

For end users, the opportunity is clear:

Stablecoin suppliers can earn low risk yields on $USDC with 57% utilization.

This isn’t about chasing the next 1000% farm. Its about sustainable yield backed by the same assets pension funds buy.

Institutions get to unlock liquidity without dumping Treasuries, borrowing at ~3.2% and deploying into DeFi for 5–10% returns.

What I like most is the hybrid design:

. Permissioned for institutions (KYC’d collateral side)

. Permissionless for retail (anyone can supply stables).

This isn’t about chasing the next 1000% farm. Its about sustainable yield backed by the same assets pension funds buy.

If you wish to position at the forefront of the TradFi-DeFi convergence, then you should pay attention to Aave Horizon.

9.81K

84

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.