Where does capital hide when narratives are quiet and price is chopping?

I think the quiet rotation’s already underway… ETH ETF is live, BTC’s stuck in a crabwalk, and DeFi yields are limp.

So where’s the “safe” yield flowing?

#RWAs might be creeping back into the conversation and I’m already seeing signs:

– Total RWA Onchain now $25.45B

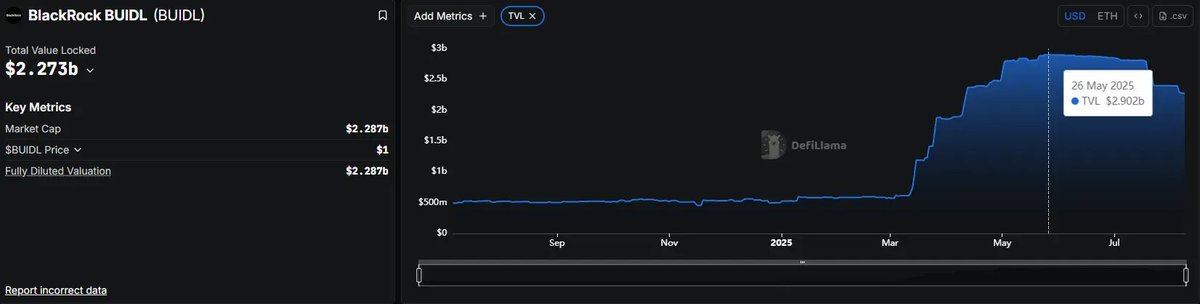

– BlackRock’s BUIDL ballooned to nearly $3B

– #Ondo’s products gaining traction across degen DeFi, DAOs, and institutional allocators

– Tokenized Treasuries yielding ~4.5%

Meanwhile, LSDs sit around ~3%. Curve and Aave are still flat unless you’re chasing boosted pools.

What’s interesting is how the macro is on RWA’s side.

ETH ETF approval → institutional flows inbound → yield-seeking capital needs clean, scalable wrappers → RWAs are one of the few crypto-native primitives that don’t rely on retail FOMO to make sense.

The playbook now looks something like this:

– Park idle stables in Ondo’s USDY or #OpenEden’s tokenized T-bills and collect ~4.5% like it’s an onchain robo-managed money market

– Stack higher yield with #Maple or #Centrifuge pools, earn 8–12% if you’re down to take curated credit risk

– Or blend it with LSDs and RWA collateral loops if you’re comfy with leverage and smart contract spaghetti

Institutions want yield with stability and they’re comfortable parking capital in RWA wrappers that behave like money market funds.

So when farming without a strong trend, I’d argue the Q3 meta is about capital preservation with optionality:

→ 50% in tokenized Treasuries (USDY, BUIDL, OUSG) for ~4.5% base yield

→ 30% in stETH for ~3%, possibly restaked

→ 20% in volatile upside

If ETH pumps off ETF flows, I’m still long. If nothing happens for 3 more months, I’m still farming 5–7% with minimal risk.

Long boring might just outperform fast dumb again.

113.99K

119

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.