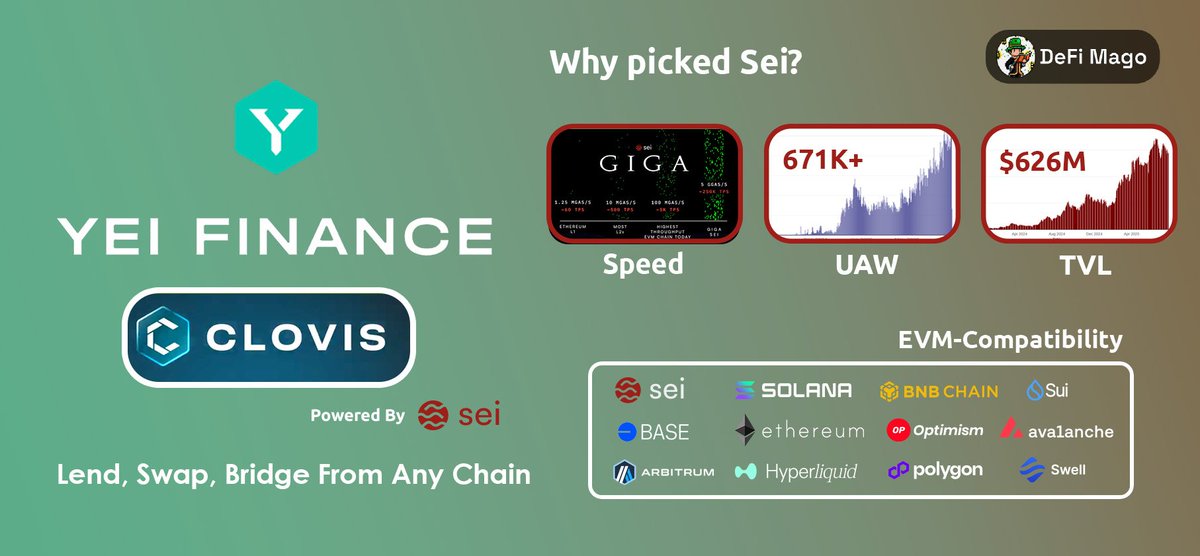

On @SeiNetwork, DeFi has always been a core focus, aiming for a fast, on-chain decentralized experience. Launched in June 2024, from a $2M funding round, @YeiFinance has accumulated more than $300M in TVL. Accounted for more than 50% TVL on Sei ecosystem, Yei became the dominant DeFi platform on Sei ecosystem. Yei was built by two core components: • YeiLend: a pool-based money market - base layer of yield on Sei network • YeiSwap: a concentrated liquidity DEX, built on top of YeiLend - rewarding lenders with trading fees Liquidity can be shared between lending and swapping natively, creating revenues from lending rewards and trading fees, for that Yei has generated millions worth of yield for users. ==== But their vision didn’t just stop there, Yei team’s goal is to innovate on-chain liquidity scene. They are aiming for a unified, self-custodial mega execution layer where lending, swapping and bridging all work seamlessly across chains. To do this, Yei team has come up with a...

21.25K

121

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.