🔥Why I chose @anoma ?????

As a researcher in the market, specializing in DeFi, I clearly see the issue of fragmented liquidity across chains.

Simply put: @Uniswap has many faces on many chains, these are copies of Uniswap, and they operate separately.

And the liquidity pool of $ETH / $USDC on Uniswap on each chain is different.

But essentially, they are still the pair $ETH / $USDC, why can't they be combined into one?

That is the question I have always sought to answer?

As you can see, does the pair $ETH / $USDC on CEX distinguish which chain it is on?

Definitely not!!!!

And thanks to that, no matter which chain you are a user of, you can trade the same pair $ETH / $USDC on CEX (for example, @binance), so liquidity is concentrated > the better the liquidity, the less slippage in trading.

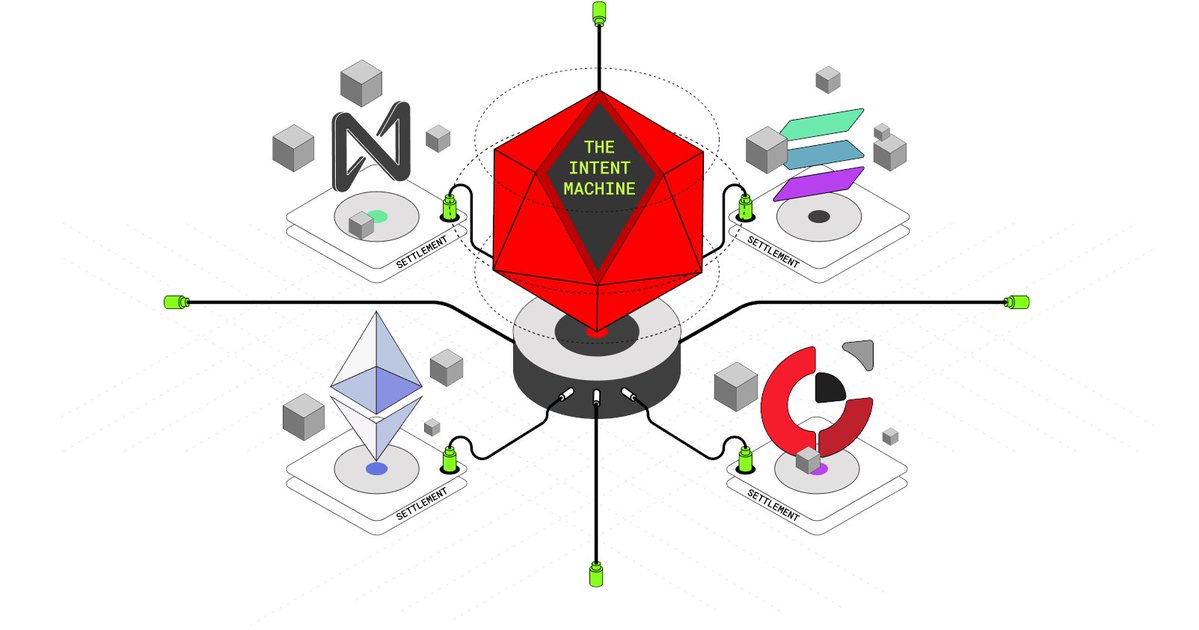

And the Intent Machine that @anoma introduced can do something similar to the previous example on CEX:

Specifically: I create an AMM Pool for the pair $ETH / $USDC on @anoma, then at this point, $ETH and $USDC from any chain can be sent to that Pool.

- User A sends 1 $ETH from the @ethereum network to the Pool, then @anoma sees that as an intent, and the Solver will create a transaction for that order recorded on @ethereum.

- Similarly, User B sends 100 $USDC from the @monad network to the Pool, the Solver will create a transaction for that order recorded on @monad.

- User C sends 2 $ETH from the @megaeth_labs network to the Pool, the Solver will create a transaction for that order recorded on @megaeth_labs.

- User D sends 200 $USDC from the @FogoChain network to the Pool, the Solver will create a transaction for that order recorded on @FogoChain.

At that time, @anoma will record the AMM Pool as having 3 $ETH / 300 $USDC.

Meanwhile:

- @ethereum records the AMM Pool as having 1 $ETH

- @monad records the AMM Pool as having 100 $USDC

- @megaeth_labs records the AMM Pool as having 2 $ETH

- @FogoChain records the AMM Pool as having 200 $USDC

> Therefore, users of @anoma will benefit from the best prices thanks to liquidity being pooled from both @ethereum, @monad, @megaeth_labs, and @FogoChain.

This is what is called solving the problem of fragmented liquidity across multiple chains or non-fragmented liquidity.

> That is also the meaning of the phrase "@anoma is all chains, not just one chain".

> That is just one application and the capability of the Intent Machine of @anoma.

In addition to the product that solves the limitations of the multi-chain market, I have 3 more reasons:

- Team: The team has the capability and experience in building key products of @cosmos.

- Backer: Raised 60 million USD, although it has been a while and some of the money may have been spent, the project still maintains its appeal to VCs over the years.

Some tier 1 funds participating show that they also value the team's capabilities and the product's potential.

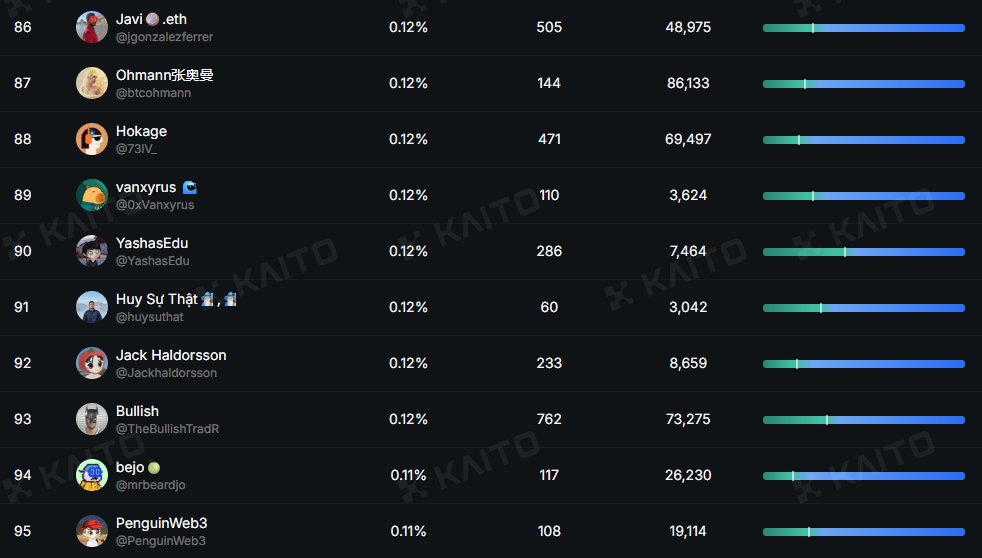

- Build community: Currently, it seems that @anoma is the most fomo and the project has the strongest community. Although learning from the build direction of @SuccinctLabs, this is probably the project with the smartest build strategy.

👉But to be honest, until now, I still do not fully understand the techniques or how the project operates.

With the documents that the project provides, I find them quite macro and hard to understand. Either I am weak or the project writes too complicated to understand.

If a person with some experience and knowledge like me cannot fully understand the project, how can many newcomers out there understand it?

I hope that @anoma has a docs version for users that provides enough knowledge, detail, and simplicity so that anyone can grasp all the information about @anoma.

@thekerukeion

@intrenche1

@anomafoundation

@heliaxdev

@hellomonty_

@anomafoundation

@chimpfone2047

@MauriceWbr

@awasunyin

@Chri5H0lt

@adrianbrink

@thespacecatjr

10.54K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.